Our Vision & Mission

We are committed to empowering individuals, micro‑entrepreneurs, and small businesses through innovative financial solutions and strategic expertise that foster sustainable growth. By providing seamless access to saving, borrowing, and investing, we enable our customers to achieve their financial goals and strengthen their long‑term success.

Airtime/Data Service

A convenient and seamless service that enables you to purchase airtime or data directly to your registered phone number linked to your bank Account.

Transfer Service

The transfer option allows you to transfer funds to other account or other customers using RIC Microfinance Bank Limited or other banks.

Bill Payment

Bills payment allows you to settle various obligations electronically and ensures timely payment of utility bills, subscriptions, and other recurring expenses.

Investment Service

With seamless access to various investment options, you can manage your funds and track the growth of your funds anytime, anywhere.

Loan Service

Our Loan Service is a digital lending model that enables our customers to access loan offers. This approach processes disbursement in few minutes.

Transforming Businesses Since 2008

BetaKash is a mobile banking application developed by RIC Microfinance Bank Limited, a Central Bank of

Nigeria (CBN)–approved microfinance institution. The platform is designed to bridge the financial

inclusion gap by offering convenient, secure, and accessible banking services to individuals,

micro‑entrepreneurs, and small businesses that traditionally lack access to formal financial systems.

Through BetaKash, customers can seamlessly save, borrow, and invest, while also enjoying access to

tailored micro‑loan products that empower them to grow their businesses and achieve their financial

goals. The app provides an intuitive interface that simplifies everyday banking, enabling users to

perform transactions, monitor their accounts, and manage their finances with ease.

RIC Microfinance Bank Limited leverages BetaKash to deliver innovative financial solutions that promote

economic empowerment, support entrepreneurship, and foster sustainable growth within underserved

communities. By combining technology with trusted banking expertise, BetaKash ensures that customers

benefit from reliable financial services that are both affordable and inclusive.

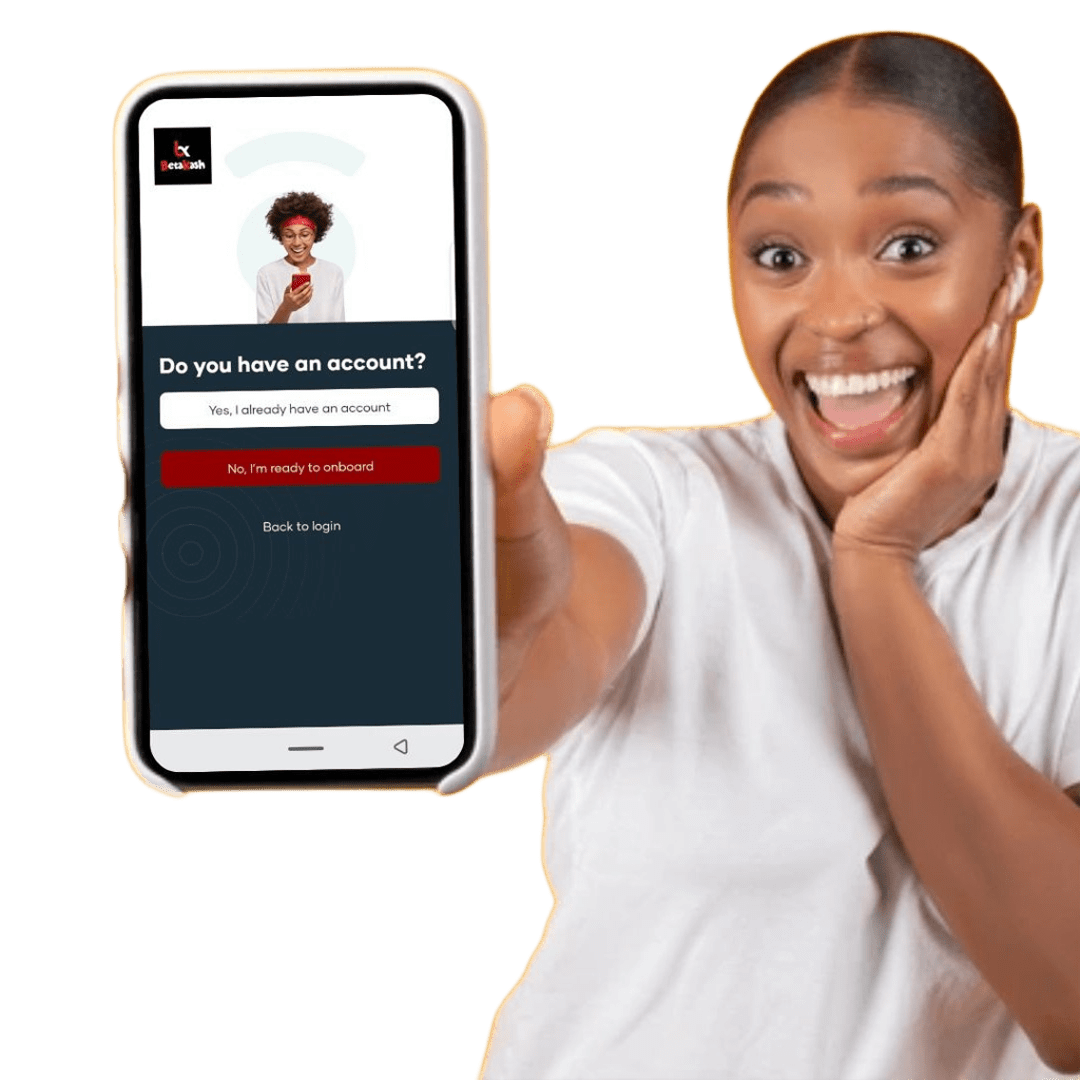

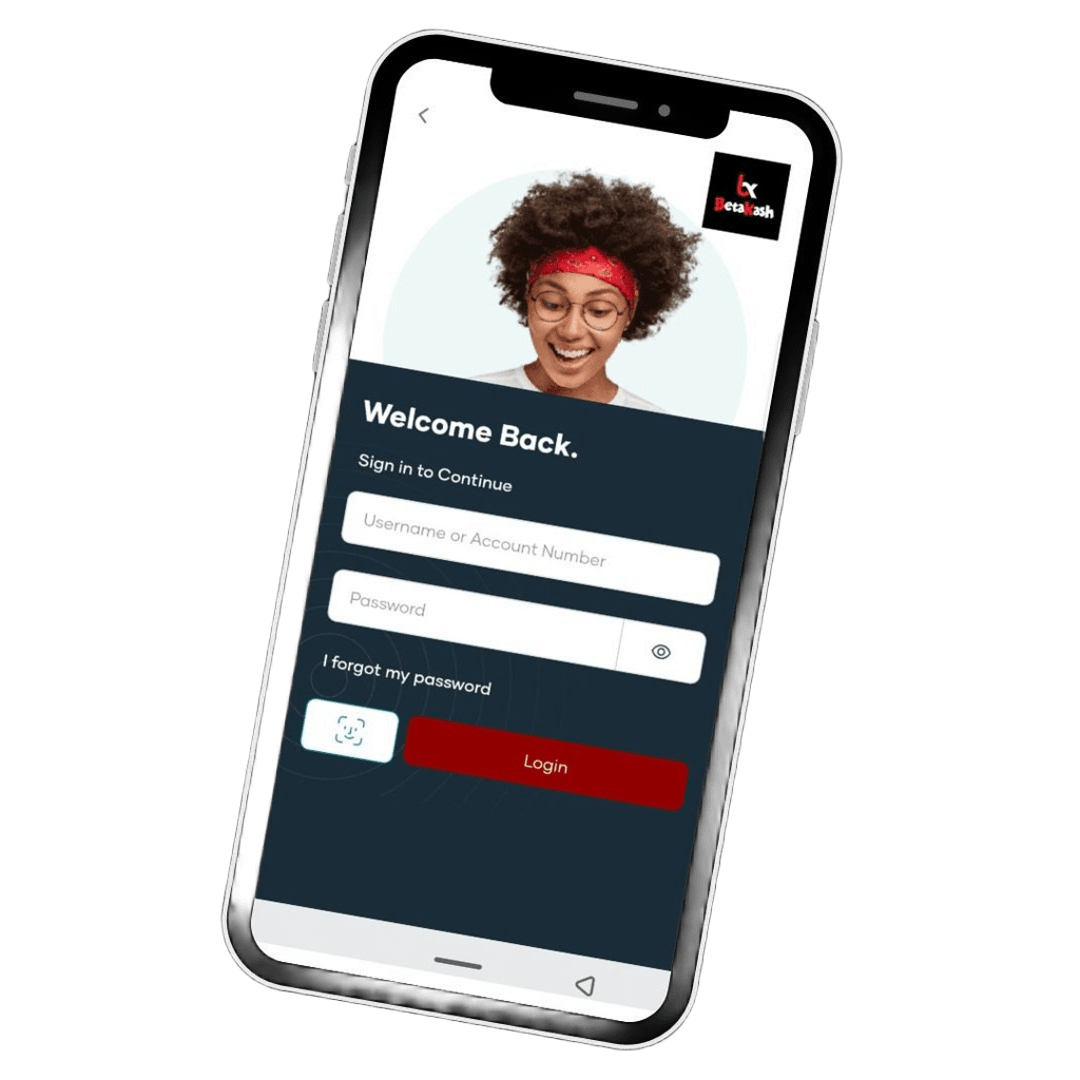

BetaKash Mobile App Onboarding Process

The BetaKash Mobile App Onboarding Process guides new and existing customers through secure, seamless account setup.

Download & Install

Customers download the BetaKash Mobile App from the Google Play Store or Apple App Store. Install and launch the application on their mobile device.

Account Registration

New customers should select “No, I am ready to onboard” and proceed to provide their basic personal details, including BVN and date of birth. Existing customers, on the other hand, should select “Yes, I already have an account” and supply their BVN, account number, and date of birth for verification. A One‑Time Password (OTP) is sent to the registered phone number for verification.

Profile Setup

Users set up their profile by adding additional details. Security features like PIN or biometric authentication are also configured.

Dashboard Access

Upon successful onboarding, customers are granted full access to the BetaKash dashboard, enabling them to seamlessly utilize all available services.

Unlock Your Financial Potential Today!

Join thousands of satisfied customers who are achieving their goals with BetaKash’s innovative mobile banking solutions — making it easier to save, borrow, and invest with confidence.